ny paid family leave tax category

The check box on the uncommon situations screen is for PFL benefits that you received that are included in your W-2. Based upon this review and consultation we offer the following guidance.

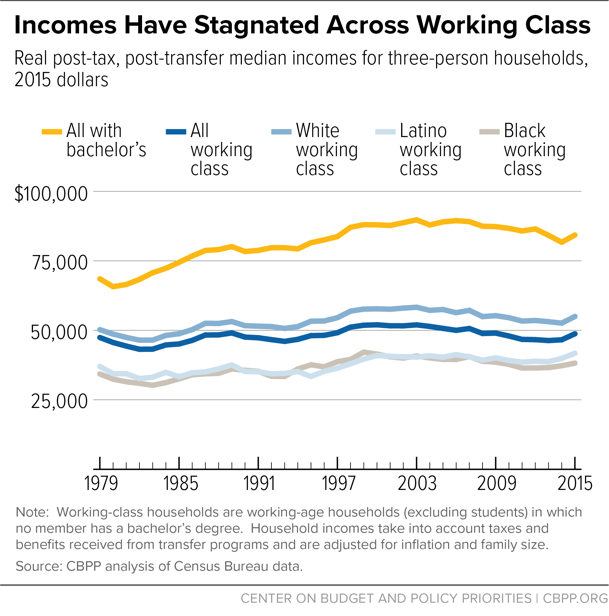

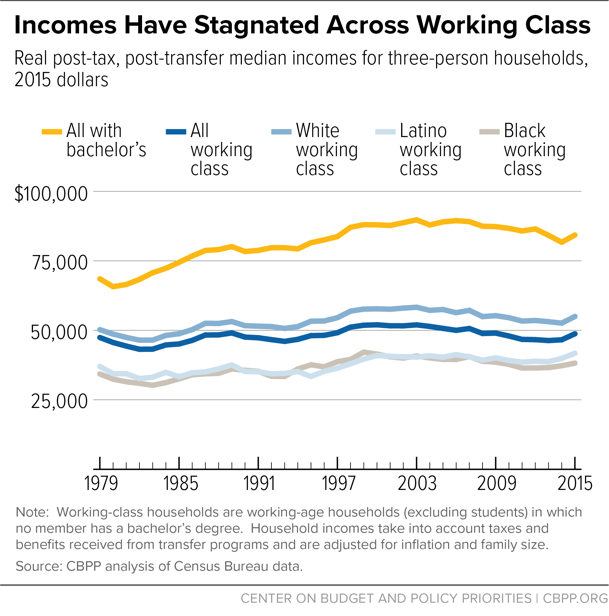

How Tax Reform Can Raise Working Class Incomes Center On Budget And Policy Priorities

Agency Health Department of.

. Employers may collect the cost of Paid Family Leave through payroll deductions. Now after further review the New York Department of Taxation and. There should be a drop down code for NY PFL as a deductible mandatory state tax.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. Occupational Category Administrative or General Management. Ask questions get answers and join our large.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Understanding NYPFL Category On Your W-2 Tax Form. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Paid Family Leave provides eligible employees job-protected paid time off to. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a.

What category description should I choose for this box 14 entry. NYPFL or New York Paid Family Leave has caused some confusion regarding tax for New Yorkers. The NYPFL in box 14 is PFL tax that you paid.

New York Paid Family Leave is insurance that is funded by employees through. Be that employees employers or. You have one for NJ.

They are however reportable as. New York Paid Family Leave premiums will be deducted from each employees after tax wages. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Title Health Program Administrator 1 - 51491. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Each year the Department of Financial Services sets the employee contribution rate to match. Benefits paid to. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages.

Tax treatment of family leave contributions and benefits under the New York program.

Paid Family Leave Expands In New York The Cpa Journal

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

New York Paid Family Leave Resource Guide

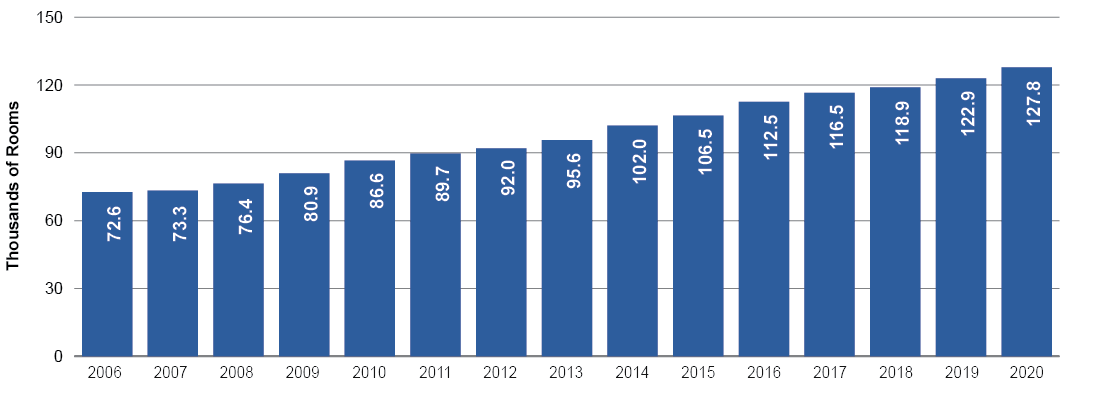

The Tourism Industry In New York City Office Of The New York State Comptroller

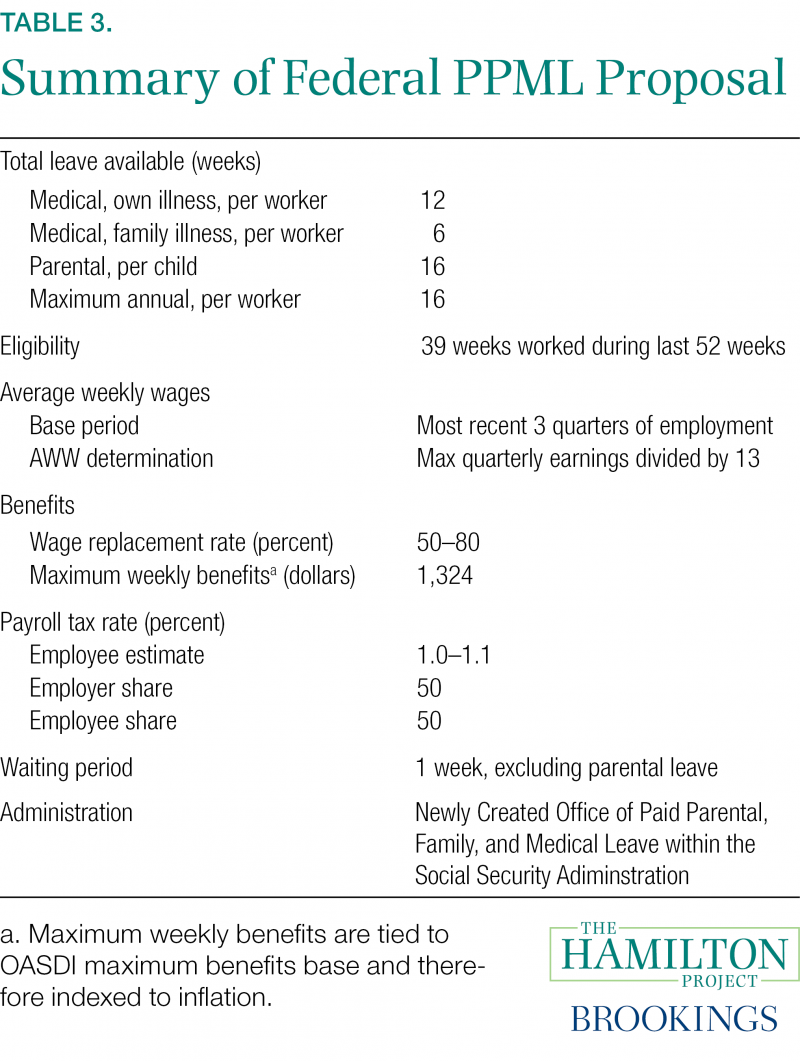

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Cfs Tax Software Inc Software For Tax Professionals

Tax Changes For 2022 Kiplinger

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Upper Class Definition Based On Income And Other Factors

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

What S A Middle Class Income Bet You Don T Know

New York State Paid Family Leave Cornell University Division Of Human Resources

6 Need To Knows About New York State Paid Family Leave Burr Consulting Llc

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance

New York Paid Family Leave Updates For 2022 Paid Family Leave